Today, in many organizations, management and financial analysts tend to focus and spend significant efforts on analysing historical sales, current income data and cashflow as a path to guidance for the assessment and interpretation of financials and growth in revenues.

But there is an increasing need for organizations to shift their focus and time towards a strategic indicator which can act as the key determinant of sales growth, financials, or valuation. That is financial forecasting.

Forecasting as a strategic tool is becoming increasingly crucial and indispensable for assessing and improving the business value. For instance, an organization’s enterprise value financially is based on its present discounted value of its free cash flow projections. Through forecasting of future cash flows, you can develop a game plan for achieving the earning objectives. Insights into the future say for 2 to 3 years ahead, can help evaluate the viability and effectiveness of your business strategy with a focus on meeting longer term goals.

Furthermore, forecasting can guide from an operational perspective such as for instance, to realize a 3X growth in the future, what sort of operational initiatives and core product or services business drivers should be augmented. This would let your business to change and tune its resources, process, and technology elements between making longer term strategic investments and tactical, short-term sales & marketing investments.

Financial forecasting as a strategic tool has the following attributes and correlation to your business aspects that you need to understand and leverage.

- The ability to make longer-term forecasts on company’s resource requirements and financials such as revenues and cashflows. Insights into a long-term horizon can help elucidate the effect of improvement in Organizations’ new plans and capability building measures which has less relevance on a shorter-term.

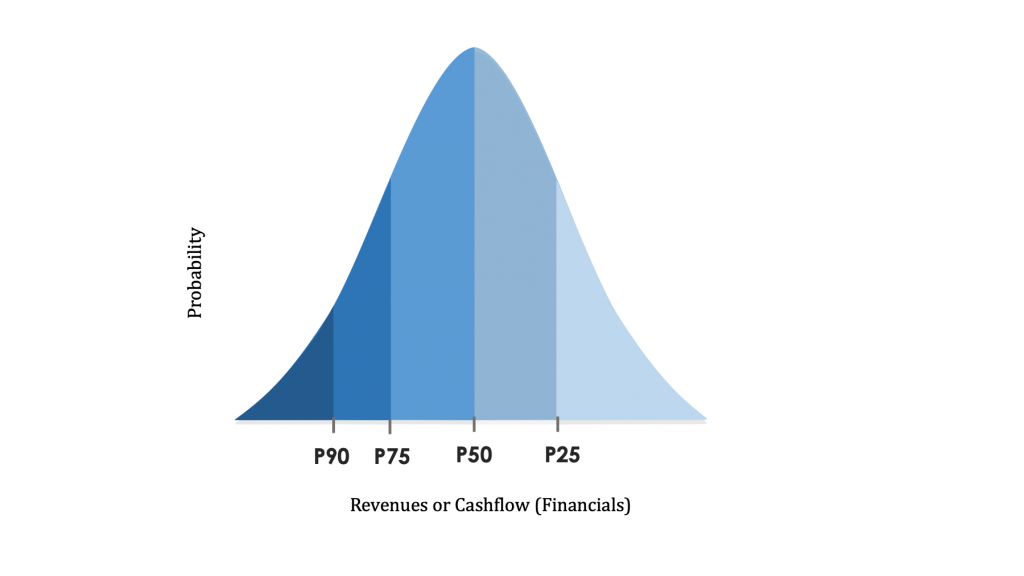

- Forecasting as a strategic tool can help reaffirm your organization’s industry and market position. Forecasting that is accurate and that can quantify uncertainty can provide deeper insights about how your industry and market is evolving and your addressable market share in a national or international market. The available strategic options for business growth based on forecasting can provide a conjecture about what sort of new resources and capabilities you require and how you can steer growth towards results.

- Your organization’s projected growth rates and profit margins especially given a longer-term should shed light on the industry competition and your differentiation. So, if you forecast higher growth rates, you must explain the core drivers, competitive edge, sustainable factors and how much further you would penetrate the markets. Furthermore, projecting into the future and an after-horizon, post-mortem assessment would seek actions for changes, remediation, and improvements from your other business departments.

- A great forecasting can drive stakeholders across your organization to think, plan and act effectively in ways to meet your business growth and financial targets in each industry context and mark dynamics. Therefore, your organization should consider assessment of outcomes of forecasting performance as an opportunity to learn and understand business gaps and challenges and hence be informed and prepared for fine-tuning its choices in business.

- Forecasting in your business is an ever-active process and an observable gauge, that should be periodically updated to observe changes in your operations and market. Rolling forecasts are particularly important if your organization is in an in evolving market or if you have ongoing transformational initiatives. Revised, rolling forecasts epitomize the perspective that business do not typically go according to plan and therefore there is a need to actively peek in to the future, track adjust and then continue to head in the most relevant and promising directions.